July 2022 Light Vehicle Production Forecast update

The following reflects the S&P Global Mobility July

2022 Light Vehicle Production Forecast update:

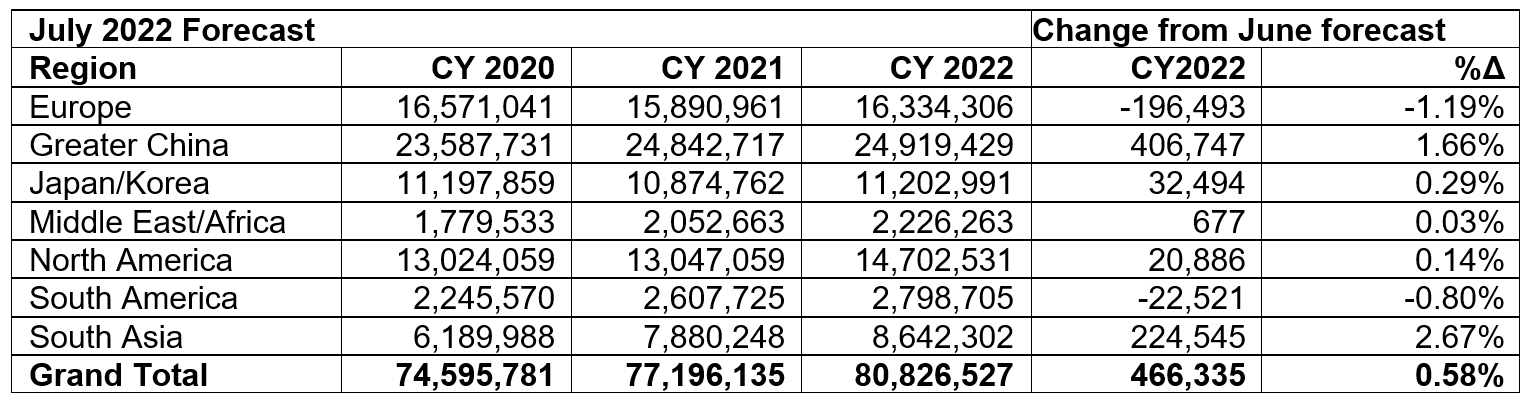

The July 2022 light vehicle production forecast update reflects

the mixed effects of recovering Greater China and South Asia

markets offset somewhat by lingering supply chain pressures in

other regions. We remain mindful of deteriorating economic

conditions. However, the auto industry is already operating at, or

near, recessionary levels influenced by supply chain challenges,

the Russia/Ukraine conflict and ongoing COVID dynamics, among other

influences.

Economic headwinds are expected to prove more impactful and

contribute to demand destruction in 2024 and beyond even as supply

imbalances are reduced. It will be important to keep a watchful eye

on inventory levels as the transition from supply constrained to

demand driven (and demand that is ultimately vulnerable to macro

pressures) could be rapid and vary from market to market.

This month’s forecast update reflects a near-term increase for

Greater China due to stronger demand with COVID lockdowns expiring

and stimulus taking effect as well as a stronger near-term outlook

for South Asia. Conversely, lingering supply chain impacts from the

recent lockdowns in China result in downward revisions for Japan

and general supply chain pressures continue to impact the near-term

outlook for Europe and South America. Further, there remains a

heightened focus on demand and production in 2024 and beyond as

markets shift from supply constrained to demand influenced in the

face of deteriorating economic fundamentals.

This article was published by S&P Global Mobility and not by S&P Global Ratings, which is a separately managed division of S&P Global.