Partner Ops: The forgotten ops that’s suddenly thriving in the ecosystem era

tl;dr — The State of Partner Ops and Programs is a “must read” report for martech.

A month ago, I wrote about how channel, partner, and ecosystem tech is one of the hottest categories in martech today. As businesses become increasingly interwoven with each other in serving customers in a digital world — where nearly everything can be adjacent to everything else — a whole wave of new opportunities for innovation are opening up.

The result: the blossoming of tools and platforms designed to orchestrate partner ecosystems. In particular, second-party data solutions — coordinating data-driven insights and activities for shared prospects and customers among partners — are evolving rapidly.

If you thought account-based marketing (and sales) products were a big deal for martech and marketing operations — and they have been — this new wave of ecosystem-based marketing (and sales, and service) products are even more game-changing.

Allan Adler, one of the leading experts in this field, has framed this as a shift from go-to-market to go-to-ecosystem.

But as you know, success with martech is 10% technology and 90% people, process, and strategy. Partnership and ecosystem management is no different. Great partner ops — one more facet of the larger trend in Big Ops — is crucial to harnessing the power of these new technologies.

Partner ops has been around as a specialized function for a long time, mostly focused on traditional channel management with resellers. But while marketing ops, sales ops, and the hybrid of revops have received a ton of attention with massive growth in their capabilities and responsibilities over this past decade, partner ops has remained in the background. It’s been the “forgotten ops.”

But that’s changing, and it’s changing fast.

Fascinated by this revolution in partner ops, Jay McBain, Asher Matthew, Kelly Sarabyn, and I teamed up to run one of the most definitive studies of partner ops yet produced. Jay is the chief analyst for global channels at Canalys and is widely recognized as the world’s leading analyst in this space. Asher is the co-founder of Partnership Leaders, a community of 1,000+ SaaS partnership executives (he’s also VP GTM at Demandbase). Kelly works with me at HubSpot, where she leads platform ecosystem advocacy and I serve as VP platform ecosystem.

Along the way, an amazing cast of who’s-who in the field of partnerships and ecosystems joined in to contribute. The result is a 94-page The State of Partner Ops and Programs report, which you can download for free.

Let’s take a look at a few key findings from 664 partnership professionals…

Many Flavors of Partners, Converging

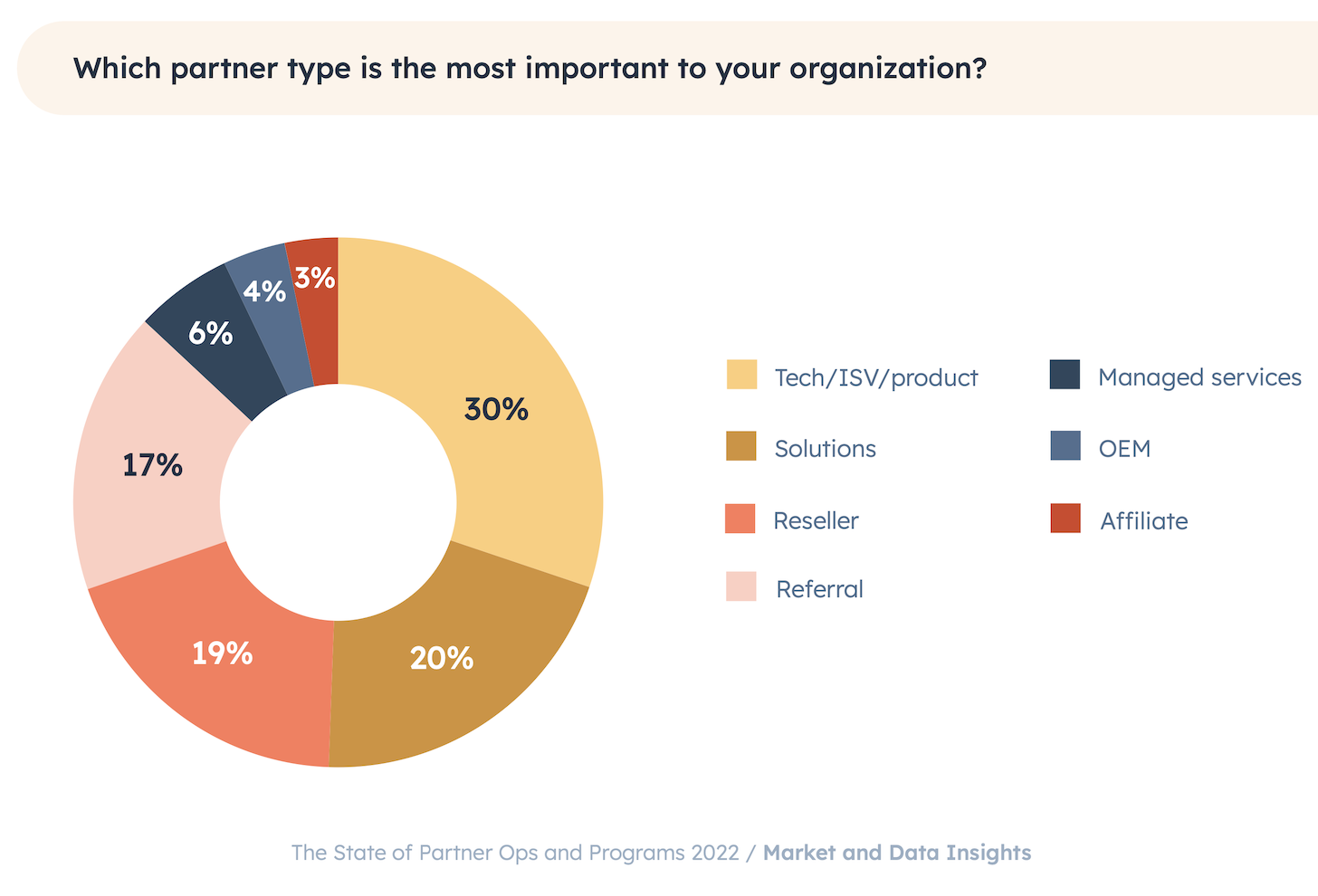

There are many kinds of partners. Affiliate partners. Reseller partners. Referral partners. Solutions partners. Tech partners (ISVs). Managed service providers (MSPs). OEMs. On average, companies have 3.6 different partner types they explicitly engage.

Given the high participation of tech firms in this study, especially SaaS companies, it’s probably not surprising that 30% of them identified tech partnerships — ISVs building apps and integrations for their platforms — as their most important partner type.

However, more sales and services oriented partnerships are collectively top of the heap. The combination of solutions partners, resellers, and managed services partners were the most important partner type for 45% of them.

Of course, the exciting plays with ecosystems aren’t just the work within these individual partner types, but the way that they’re interconnected. Jay has identified that the average customer uses 7 partners along its buying journey today.

Great Partner Programs Need Great Partner Ops

77.6% of all the organizations surveyed (and 92.6% of enterprise-sized ones) have an official partner program. Instead of bespoke, one-by-one partnerships, programs are designed to support scale in partner ecosystems. 56% of these programs use a partner tier model to incentivize and support a large number of partners in a fair and consistent manner.

But managing hundreds or thousands of partners in these programs is challenging.

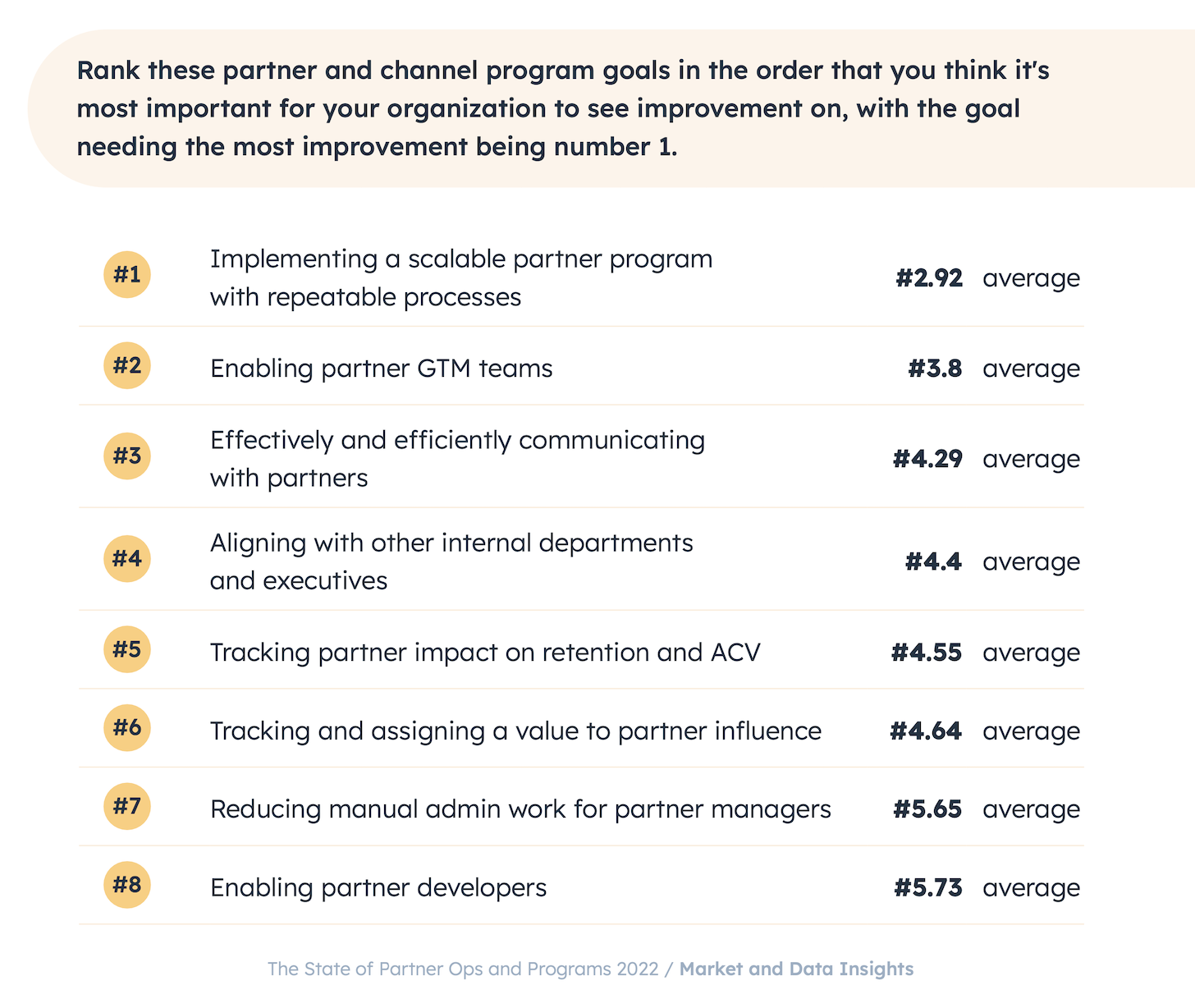

In our study, these were the top goals partner program leaders felt needed the most improvement, which give you a terrific overview of the kinds of work that partner ops professionals tackle:

The biggest factor blocking organizations from making these improvements in their partner operations? 51.8% report lack of internal partner ops expertise, followed by 47.3% who report they’re challenged by not being well-aligned with other internal departments.

Sound familiar? This is highly analogous to the long journey marketing ops — and more recently revops — have had to march uphill for the past decade. Ironically now, a huge part of the opportunity for partner ops is better alignment with marketing ops and revops. We should have deep empathy for each other.

Partner/Ecosystem Tech Stacks and Adoption

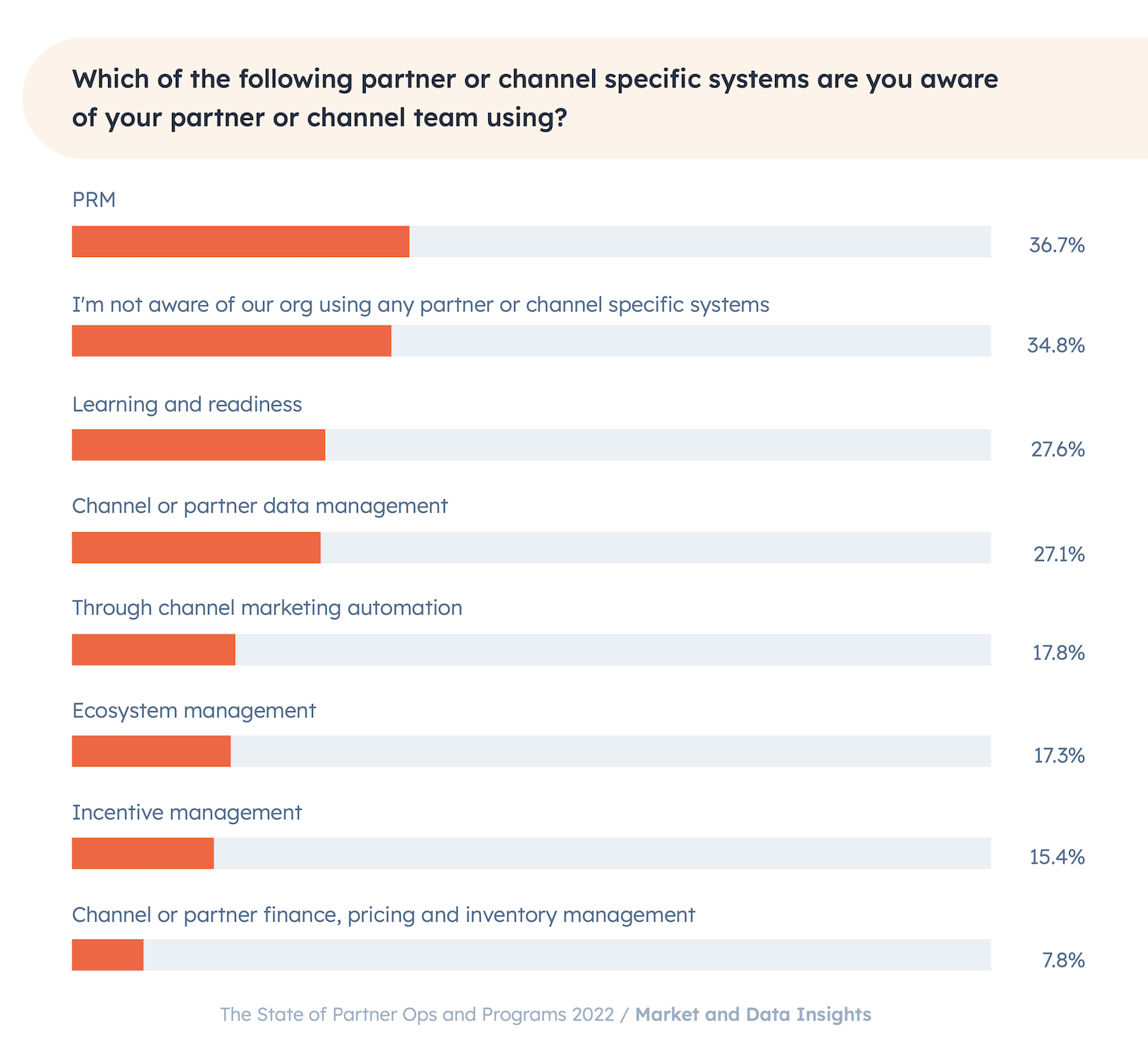

What about partner/ecosystem tech? There’s a ton in the market now, yet adoption of different solutions is still relatively light:

Not coincidentally, the combination of (a) a seismic shift in business towards embracing ecosystems, (b) a wave of new innovative products to serve that opportunity, and (c) a huge TAM for those products that is largely underpenetrated have had VCs and private equity firms pouring a ton of money into this space. Just in 2021, $3 billion was invested in this category.

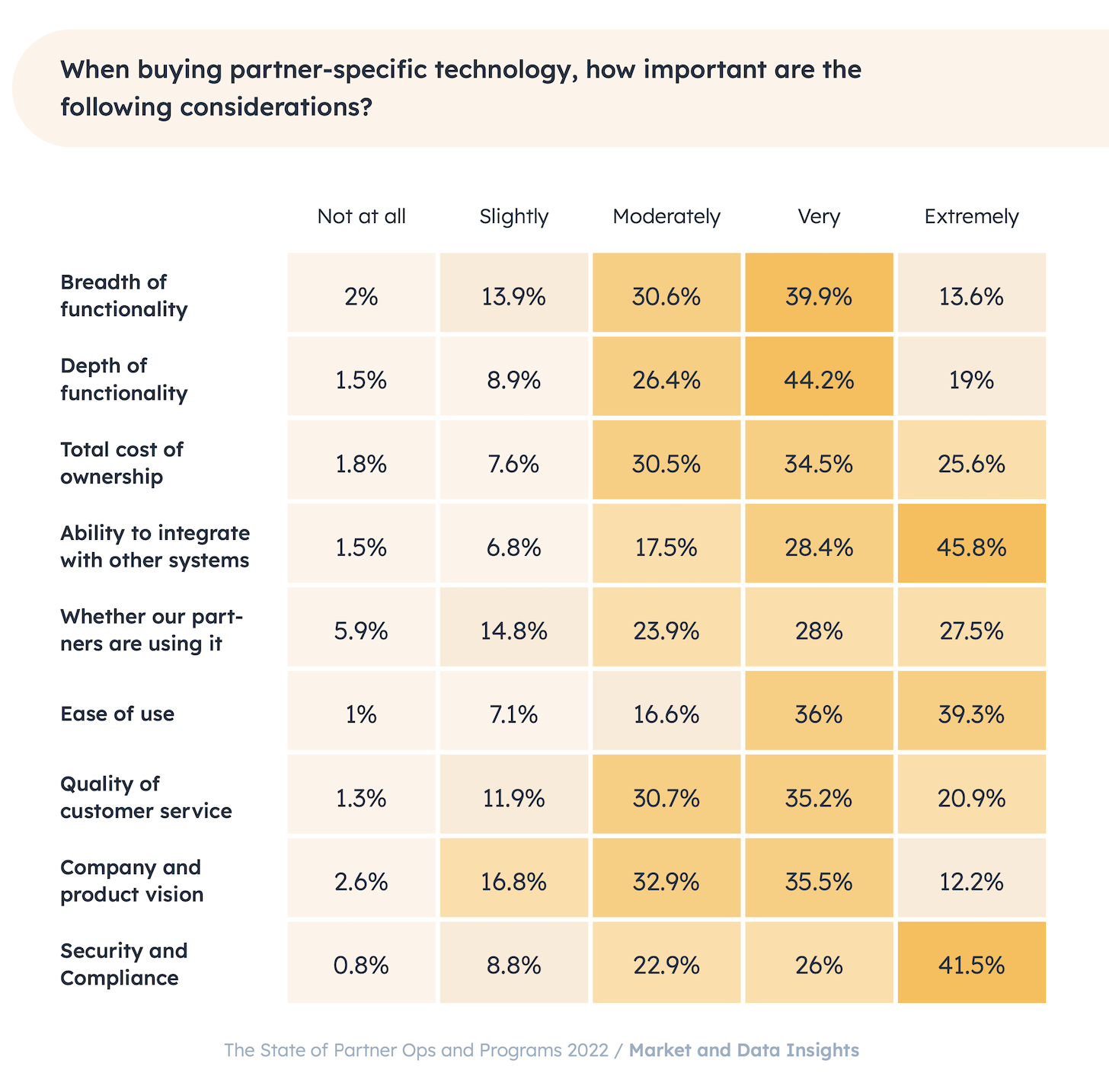

How do partner teams evaluate partner tech products? Again, not that differently than marketing teams evaluate martech:

I will point out that integration is the most important factor for buyers, with 74.2% reporting that a product’s ability to integrate is either a very or extremely important consideration.

Not surprising, given the same holds true for martech (as shown here, here, here, here, here, here, and so on).

And since alignment and execution with many other departments in an organization is so important to harnessing the full value of partner ecosystems, integration between partner systems and the rest of the marketing, sales, and service tech stack are critical path.

Of course, there’s something deliciously meta about this too: partner tech products integrating in other ecosystems — and building their own ecosystems — to better facilitate other companies building and integrating their partner ecosystems. It’s turtles ecosystems all the way down!

“But are these specialized partner/ecosystem tech products worth it?”

A fair question, seeing as my previous post was arguing for stack simplicity and that other things being equal, the simplest tech stack is best. My real point was that stacks should be as simple as possible, but no simpler. Implement the capabilities your business needs to thrive. Partner tech is generally additive in this regard.

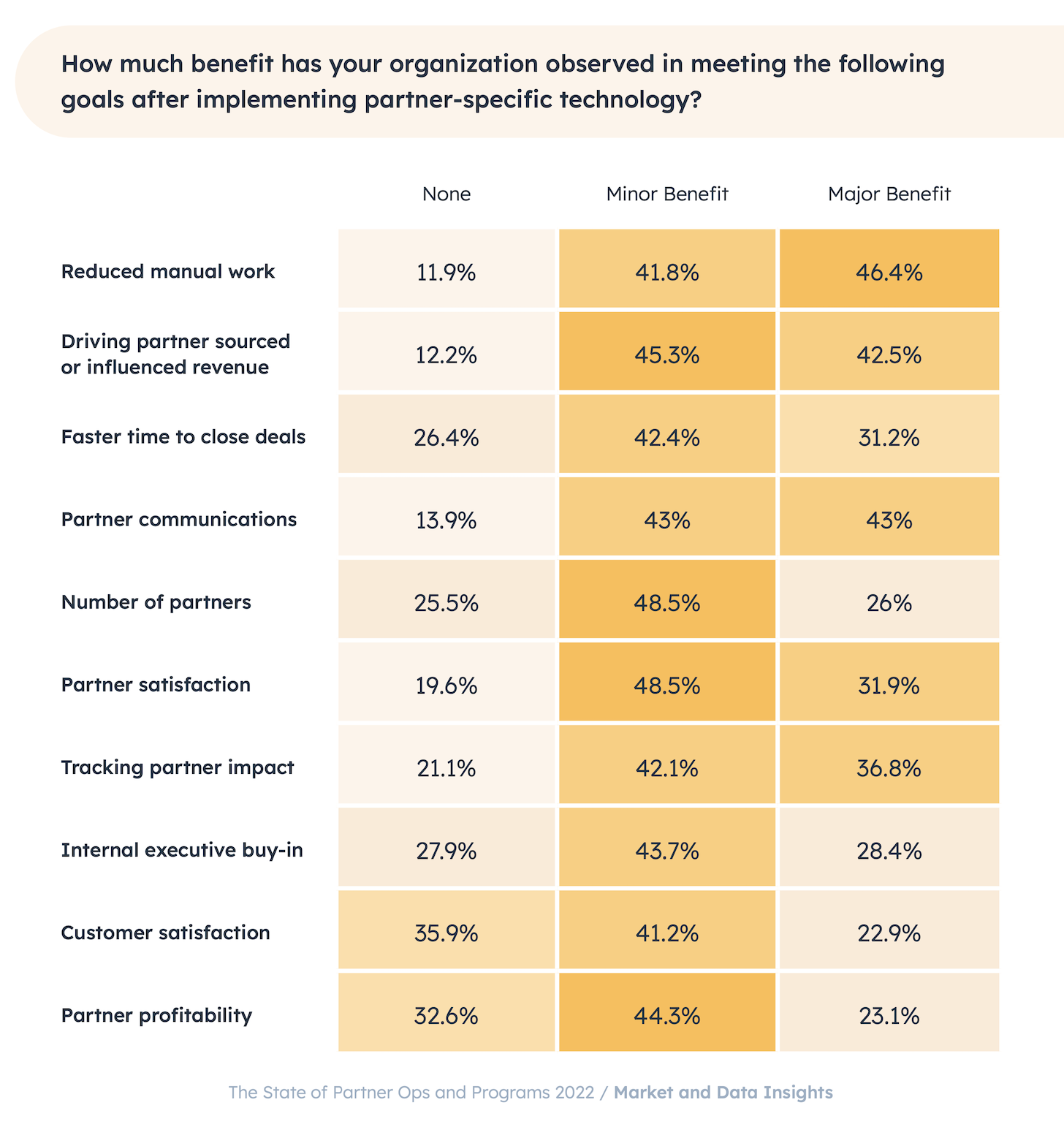

So here are the benefits partner teams are seeing with these technologies:

An MBA in Modern Partner Ecosystem Management

I’ve barely scratched the surface of the data and insights from The State of Partner Ops and Programs. This is by far the most comprehensive report I’ve ever had the privilege to be involved in. I highly recommend downloading a free copy.

But here’s one more really big reason to get a copy.

In addition to a thorough analysis of the partner ops and programs study we conducted, the report includes 10 essays contributed by partnership leaders from some of the best SaaS companies in the world — Twilio, Okta, Asana, ZoomInfo, Xero, Avalara, Qualtrics, Procore, Contentsquare, and Aircall — explaining how they strategically think about and manage their own partner programs:

Seriously, this collection of essays from these folks is like a mini MBA in partner ecosystem management. I learned a ton from reading them.

Even if you’re not directly in charge of partnerships or partner ops, these perspectives will help you understand how to align with and harness ecosystem dynamics in your work.

A Huge Opportunity for Marketing & Marketing Ops

For marketing and marketing ops leaders, the rise of partner ops and partner tech — and ecosystem strategies more broadly — is poised to enable new and impactful strategies and tactics. The fact that these capabilities are not yet widely adopted gives you an incredible opportunity to get ahead of your competition. Given the inherent flywheel dynamics of ecosystems, early mover advantage is real.

This will be a big deal in 2023.

Partner ops will be the forgotten ops no longer.

Download your free copy of The State of Partner Ops and Programs.