May 2022 Automotive Inventory Data and Sales Forecasts

GRAND RAPIDS, Mich., May 25, 2022 /PRNewswire/ — The ZeroSum Market First Report is the automotive industry’s first source to predict month-end vehicle movement, providing vital supply and demand trend data to automotive marketers and dealers. ZeroSum uses predictive modeling to accurately estimate new vehicle inventory, pricing trends, and market share.

This May, businesses are feeling the impact of lower consumer demand, factory shutdowns, and higher production costs. Even Carvana, one of America’s largest used car retailers, felt the impact as their stock prices plummeted 90% since November. This is largely due to preparing for much higher demand levels than needed. In China, COVID lockdowns have slowed production for many manufacturers, leading to continued supply pressure. With rising raw material costs, Toyota warned that prices could take 20% off full-year profits. Due to inflation rates and rising gas prices, OEMs like Hyundai and Volkswagen are beginning to ramp up production of EVs as customers shift their focus.

ZeroSum’s Take: What You Need to Know

As new vehicle inventory remains constant, and prices for both new and used cars begin to level off, dealers are continuing to benefit from high levels of profit. However, consumers have finally hit the limit on what they are willing to pay. For dealers, this is a critical tipping point because they will need to accelerate turn rates on both new and used inventory to maintain profits and earn more inventory to sell.

Here are your key takeaways:

This month, there are 1.95% fewer used vehicles on the ground than at the end of April while new vehicle inventory remains relatively consistent. On average, a used car now costs almost as much as a new car did a year ago.

- Adjust your business model. In our last report, we talked about the stabilization of new car inventory levels being the new normal, and that remains true in May. Dealers will need to focus on used car marketing alongside new car marketing for business growth.

- Keep an eye on stabilizing prices. Be prepared to adjust your marketing as prices level off and consumer demand wanes. To maintain profit, the market pricing will have to be more strategic to meet demand.

- Be prepared for EV demand. Higher gas prices and long ordering waits are pushing consumers to purchase used electric vehicles at high prices.

To read the entire report and view supplemental charts, visit our website: https://www.zerosum.ai/blog/zerosum-market-first-report-2022-5

About ZeroSum

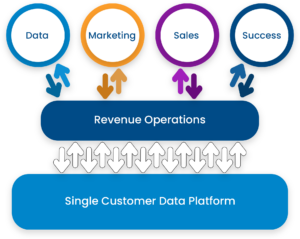

ZeroSum is a leader in software, marketing, and data. Powered by its SaaS platform, MarketAI, ZeroSum is simplifying and modernizing automotive marketing by leveraging artificial intelligence, data, and scaling ability to acquire new customers. ZeroSum is the first and only company that matches consumer demand with automotive data in real time. For more information, visit www.zerosum.ai.

For media inquiries, please contact [email protected].

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/zerosum-market-first-report-may-2022-automotive-inventory-data-and-sales-forecasts-301555252.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/zerosum-market-first-report-may-2022-automotive-inventory-data-and-sales-forecasts-301555252.html

SOURCE ZeroSum