Home Depot Q1 Preview: Long Term Prospects Are Encouraging & Valuations Are Attractive

Justin Sullivan/Getty Images News

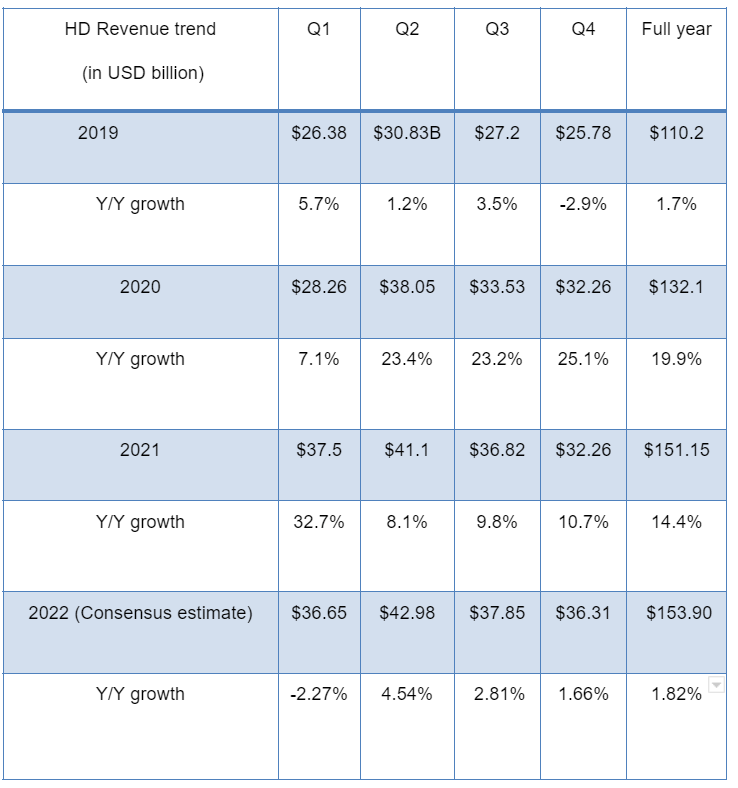

Home Depot (NYSE:HD) is set to report its earnings on Tuesday, May 17th, before the market opens. Because of the tougher comparisons (both one year as well as two-year stack basis) and macro-related headwinds, revenue and operating margins are expected to be lower in Q1 2022 than in Q1 2021. Analysts are estimating a total revenue of ~$36.67 billion, down by ~2.27% in comparison to Q1 2021 reported revenue. For EPS, the consensus is at $3.68 for Q1 2022 or a ~4.6% decline versus $3.86 last year. While the company is facing macro-related headwinds, the valuation is cheap and a lot of these headwinds seem to be already priced in to the stock at the current levels. The long term story remains intact and management’s growth and margin initiative will continue to help drive the stock’s outperformance in the longer term.

Revenue Expectations and Outlook

Back in February, while reporting the Q4 results, management provided the FY22 guidance for revenue growth to be slightly positive and operating margin approximately flat compared to fiscal 2021. The consensus estimates for FY22 are building in 1.82% revenue growth in line with the company’s guidance for FY22.

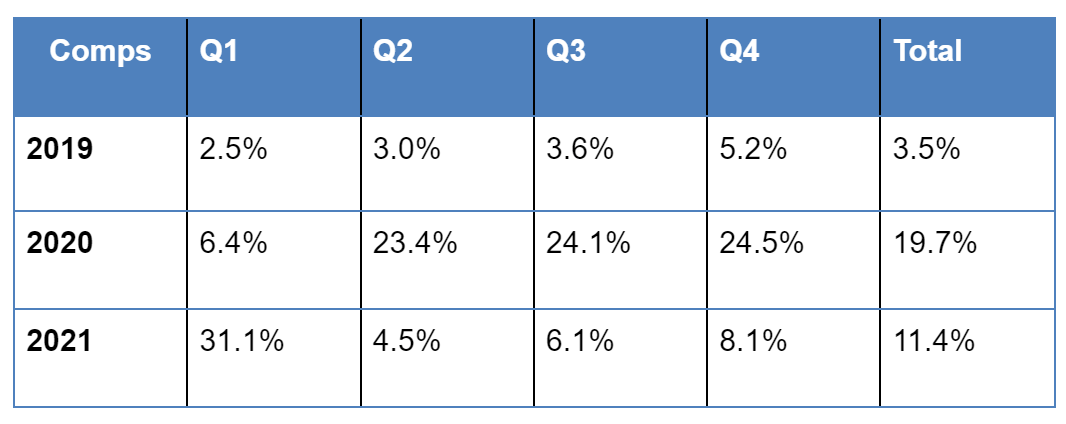

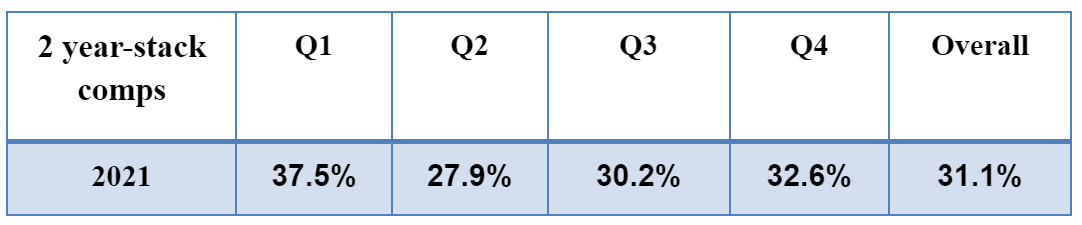

Management hasn’t given quarterly revenue guidance but if we look at the sell-side estimates, they expect a decline in Q1 with the company returning to growth from Q2 onwards. This makes sense as comparisons are tougher in Q1 2022 on both 1-year as well as the 2-year stacked basis. Analysts are estimating revenue of $36.65 billion in Q1 2022, a drop of ~2.27% from the actual reported revenue in the same quarter last year. In Q1 2021, the company recorded comps of 31.1%

HD Comps Sales (Company Data, GS Analytics Research) HD 2-Year Stacked Comps Sales (Company Data, GS Analytics Research) HD Revenue Growth (Company Data, Seeking Alpha Consensus Estimates, GS Analytics Research)

While comps are tougher in Q1 2022, if we look at commentary from some of the company’s smaller peers as well as vendors, the underlying demand trend in the remodelling industry appears healthy. While transaction and volume growth is getting impacted by strong demand from last year (tough comps), many companies were able to raise prices which resulted in revenue growth.

On its latest earnings call, Floor & Decor (FND) talked about declining transaction numbers as it laps the strong demand and tougher comparison compared to the previous year. But it also discussed the increase in ticket size thanks to the still healthy market conditions which enabled them to increase prices and offset the decrease in the number of transactions. Floor and Decor was not alone, even the company’s vendors like Fortune Brands (FBHS) and Masco (MAS) talked about their ability to increase prices for the end customers on their recent earnings call.

We expect similar dynamics for Home Depot as well, which might offset some impact of tougher comps.

Some investors are also worried about rising interest rates and its impact on Home Depot. However, if we look at historical trends, remodelling activity has been more dependent on home equity and housing prices rather than interest rates. Homeowners usually tend to spend more on home improvement projects if the housing prices are rising. So, I am not too worried about rising interest rates.

One thing which does worry me, however, is the impact of economic reopening and normalization on the near term demand. For the last two years, consumers benefitted from stimulus checks and since they had fewer avenues for spending outside their homes due to lockdown, they spent a considerable amount on home improvement. What impact the economy reopening has on this demand is something to watch closely and any commentary from management on it will be helpful.

Margin expectation and outlook

On Home Depot’s last earnings call, management provided the guidance of a flat operating margin for FY22 compared to FY21. However, I believe things have worsened quite a bit since then in terms of supply chain disruption and headwinds due to the Russia-Ukraine conflict and lockdowns in China. The company and its vendors source some of their inventory/SKUs from China and Europe. With geopolitical tensions and incremental lockdowns related to Omicron in China, there might be some pressure on margins in the near term.

However, I am not too worried about it as Home Depot is a well-run business with a leadership position in its industry. It can arrange for alternative options if it is unable to source some SKUs from China due to restricted access to Chinese ports. The company may incur some additional costs in the near term as a result, but in the long term it should be able to pass any inflationary costs to the end consumer.

Long-term Growth Initiatives

While there are short term concerns, most of them are macro related and not company-specific. Most companies across various industries are facing similar supply-chain and inflation-related headwinds.

But despite these near-term headwinds, the company’s long-term growth narrative remains intact. On its last earnings call, management shared its long term goal of achieving $200 billion in sales with improvement in in-store productivity and cost reduction. I believe these goals will remain intact and the company will not only be able to navigate through near-term macro headwinds, but also emerge stronger on the other side.

In my previous article, I discussed some of the initiatives Home Depot is taking in terms of space optimization and building out flatbed distribution centres to facilitate timely delivery to Pro customers. It will be interesting to get updates from management on these initiatives as well as other strategic long-term goals during the upcoming conference call.

Valuation and Conclusion

Home Depot is currently trading at ~18.18x FY23 (ending January 23) consensus EPS estimates versus its five-year average adjusted P/E (FWD) of ~21.90x. I believe the company’s long term growth story remains intact and given its market leadership position, history of excellent execution as well as company-specific growth initiatives, long-term investors can utilize the recent correction to buy the stock.