Are Home Improvement Stocks Now Undervalued?

The lockdowns of 2020 could have prompted customers to set extra dollars towards their environment, boosting profits for household improvement suppliers Lowe’s (NYSE:Lower) and Dwelling Depot (NYSE:Hd), but the financial and housing availability crunches of 2022 are trying to keep them there.

Home furnishings, electronics and house workplace established-ups aimed at creating residence a better area to reside and do the job fueled 2020 obtaining, but with consumers dealing with climbing expenses of gasoline and foods, theyre heading to residence enhancement merchants to take care of repairs them selves and start out gardens. This is holding advancement at Lowe’s and Household Depot solid, generating them the two perhaps rewarding portfolio additions this summer months, in my impression.

Both alternatives have mounting dividend yields, earning them interesting for price traders searching to make passive cash flow as nicely. Ahead of you incorporate both of these dwelling improvement shares to your portfolio, although, there are some cons to think about.

Lowes

Lowes (NYSE:Low) is a home advancement retail chain working in the U.S., Canada and Mexico. It features solutions for development, maintenance, repairs and transforming. The housing sector may well be cooling a very little from the highs of 2021, which might encourage assignments in the household youre in.

Revenues for the business have doubled about the earlier decade, and earnings for each share are expected to expand close to 13%. Lowe’s has a dividend produce of 1.66%, and the organization has a prolonged keep track of record of climbing dividends. That could help sweeten the deal for traders.

Analysts fee Lowe’s a obtain, even though bulls feel the firm faces hazards from climbing curiosity premiums, offer chain problems and flattening housing selling prices. Its value noting that the median age of households in the U.S. is 39 many years, an age when homes will will need an growing amount of upkeep and could be candidates for reworking.

Lowe’s receives a GF Rating of 96, pushed mainly by top rated rankings for profiability and expansion.

House Depot

Surpassing forecasts in 9 of the last 10 quarters, an additional major U.S. dwelling advancement retailer, Residence Depot (NYSE:High definition), recently claimed 10.7% development in internet sales calendar year-more than-12 months.

Residence Depot counts expert contractors amid its major shoppers, and their huge-ticket buys were up 18% through the previous calendar year. EPS has grown 17% in excess of the past three a long time and income is up 8% around the earlier 12 months, finding it a acquire score from analysts.

Household Depot has a dividend yield of 2.26%, generating it the extra appealing of these two stocks for these in look for of dividends.

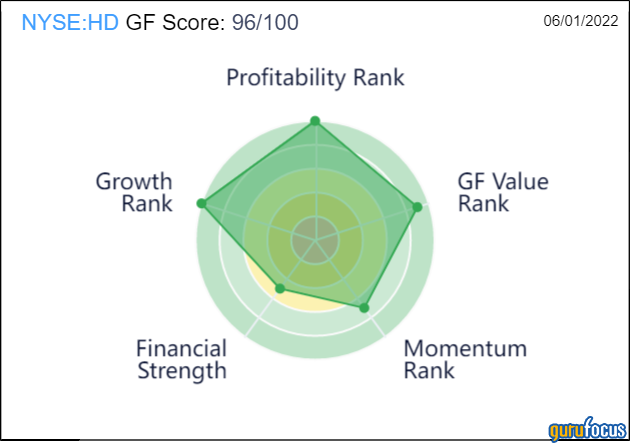

Like Lowe’s, Residence Depot also has a GF Score of of 96/100. In addition to substantial growth and profitability, it scores superior than Lowe’s for GF Price, however it loses points for weaker momentum.

This write-up initially appeared on GuruFocus.